Enterprise Zone

Enterprise Zones are an economic development tool created by the State of Oregon to encourage business growth and development. In short, enterprise zones exempt businesses from local property taxes on new investments for a specified amount of time. The length of time varies among the different types of zone programs, but the most commonly utilized is between 3-5 years.

Enterprise zones are sponsored by city, port, county, or tribal governments. The local enterprise zone in the Coos Bay/North Bend area is the Bay Area Enterprise Zone. The Port of Coos Bay is one of the four sponsoring entities for this zone, along with the Cities of Coos Bay and North Bend, and Coos County. In exchange for locating or expanding into any enterprise zone, businesses (which generally does not include retail or professional offices) receive total exemption from property taxes that would normally have been assessed on the new plant or equipment.

Businesses making an inordinately large investment (there are several types of criteria that must be met, including the total dollar amount invested, average wage paid to employees, and the total number of employees) can be eligible for a Long-term rural Enterprise Zone designation. The long-term program extends property tax abatement to as many as 15 years on the new improvements and investments.

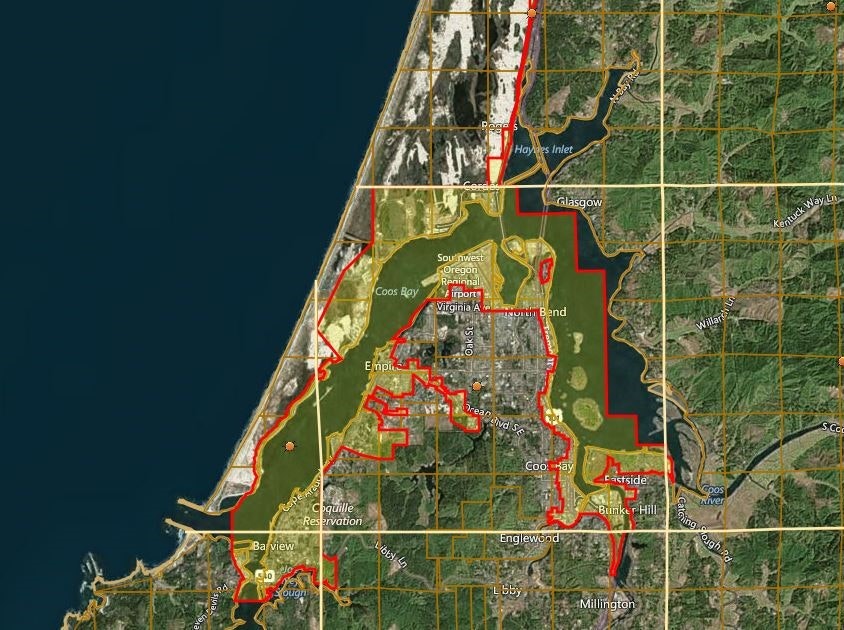

The Boundary of the Bay Area Enterprise Zone, shown in yellow shading below: